Our Blog

Every Saturday you will get 1 actionable strategy to improve the cash flow in your business

Recently Added

How to effectively manage receivables in your business

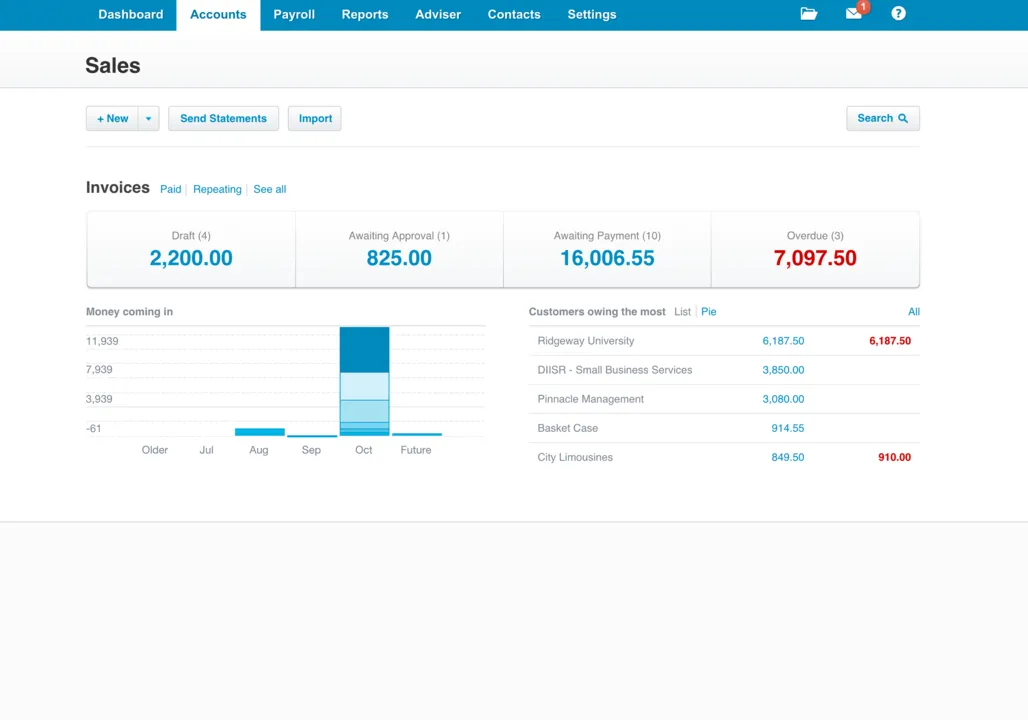

Receivables are amounts of money that a business has invoiced to customers. These amounts are due to be paid to your business. Depending on your invoice terms will determine how long they are likely to be receivables for your business.

It’s vital for a business to keep track of the amount of money it’s customers owe and how long it takes for customers to pay. The more money there is in receivables and the longer it takes for these to be paid, the harder it can be to run your business and maintain healthy cash flow.

As a business, we want consistency in how quickly we get paid and usually the faster we can get money into our business the better. If some of our customers are failing to pay bills on time, are not paying us at all or need constant chasing, we need to analyse whether we should continue working with these customers or whether we should impose an interest charge on amounts paid late in our businesses.

How to get paid quicker and ensure you get paid

There are a number of ways to ensure that you get paid quicker in your business. Some examples of these are:

>> Ensure your customers are fully aware of your payment terms and they are clearly marked on your invoices

>> If you provide longer time frame payment terms, provide customers with payment reminder emails prior to the payment being due and provide month end statements to all of your customers

>> Invoice customers as soon as jobs have been completed

>> Potentially look to get clients on a direct debit facility or use a recurring revenue model in your business

>> Automatic invoice reminders can be created in Xero when paying is overdue. This is an amazing feature that every business should use.

>> Xero has an online invoice feature which also has online payment methods, such as PayPal, shown on each online invoice. The more options a business gives to their customers to pay, the more likely they are to pay the invoice.

We recommend customers set out strict payment terms with their customers, set up PayPal to link to their online invoices and set up automatic invoice reminders for overdue invoices. This will ensure that your business will get paid as soon as possible.

If you need assistance with your receivables in your business, please contact us to discuss how we are able to assist.

Whenever you're ready, here are 3 ways we can help you:

Watch our FREE training “How to Reconcile Your Bank Account in Xero (even without any accounting experience)” by clicking here.

If you are doing less than $250k in sales and want to learn how to use Xero for your business. Check out our Xero Training Course here.

If you are doing more than $250k in sales and need a bookkeeper and accounts team for your business? Let's chat here.

ABOUT

Helping your business become financially successful by helping you understand your numbers

SATURDAY STRATEGY

Every Saturday you will get 1 actionable strategy to improve the cash flow in your business