Our Blog

Every Saturday you will get 1 actionable strategy to improve the cash flow in your business

Recently Added

How to effectively maintain payables

Accounts payable or trade debtors are amounts of money that are owed to suppliers at any given time from your business. Many businesses issue their invoices to customers and provide a certain number of days in which they have to pay the balance of their bill. These vary from close of business that day to 30 days after the end of that month.

It can be very beneficial for a business to correctly account for these and keep track of these in their accounting software. A few of these reasons are as follows:

>> A business will know how many and how much they owe to all of their suppliers

>> Business will know when each payment is due to be made

>> They will be able to compare their records against their suppliers month end statements (for example)

>> Businesses will be able to more accurately predict cash flow requirements going forward

>> You will be able to create batch payments from their accounting software to upload to online banking. Making paying of these bills much simpler.

Using Xero or add-on’s to manage and automate this process

How many times as a business owner do you struggle to know how much you owe your suppliers? Or how often do you forget to pay your bills on time? Or, worse yet, how often do you get angry emails or phone calls asking you to pay your bills?

It really is good business to pay your bills on time. Not only will your supplier be willing to continue to work with good bill payers, but some suppliers even offer discounts for paying early or on time!

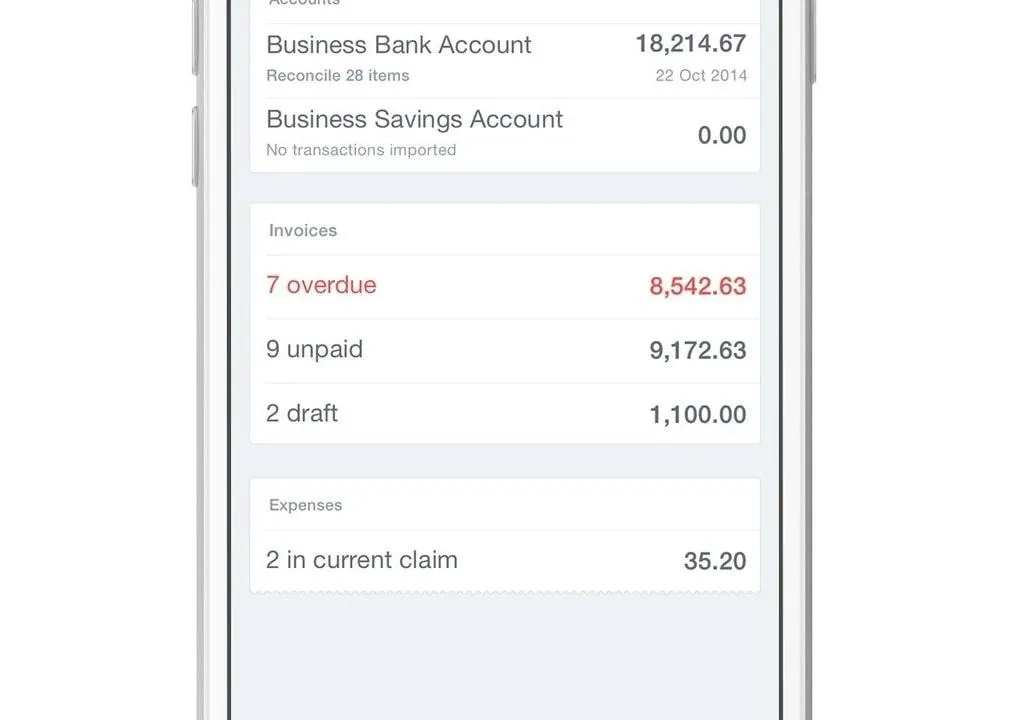

Having a whole bunch of old invoices or monthly statements on paper should never be the way to monitor your payables. At any point in time, Xero can be used to view how much money you owe each supplier and when they need to be paid. This is because Xero can also be used to generate ABA files (batch payments) to pay multiple suppliers. Just upload this file to your online banking and payments made.

Even better a tool like Receipt Bank will automate the whole process. Email directly, upload photos or PDF’s directly into your own Receipt Bank account, link it to Xero and let the magic happen. Receipt Bank will create all aspects of a bill and even attach a copy of the invoice! All in a few clicks of a button. This at least halves the time taken to process payables in your Xero file, while simultaneously keeping an audit proof electronic copy of all of your payables all in one place.

If you are hiring a bookkeeper or accounts payable person and they do not use a system like Receipt Bank, you are wasting time and money. We will discuss automation of payables with all of our clients and have find that the time and cost saving is huge. Let alone the increased accuracy of information and the consistency of how frequent the information is updated in your Xero file.

If you feel that you could be automating your accounts payable, please contact us and we will discuss the many options available to your business.

Whenever you're ready, here are 3 ways we can help you:

Watch our FREE training “How to Reconcile Your Bank Account in Xero (even without any accounting experience)” by clicking here.

If you are doing less than $250k in sales and want to learn how to use Xero for your business. Check out our Xero Training Course here.

If you are doing more than $250k in sales and need a bookkeeper and accounts team for your business? Let's chat here.

ABOUT

Helping your business become financially successful by helping you understand your numbers

SATURDAY STRATEGY

Every Saturday you will get 1 actionable strategy to improve the cash flow in your business